Introduction

Company Profile and Strategy Alignment

Key Performance Indicators and Measures

Supply Chain and Value Chain

Quality Control

Future Strategy of ExxonMobil

Conclusion

Introduction

After plunging oil prices in late 2014, the overall slump in Korea’s oil exploration & production (E&P) industry has continued. Low oil prices have hurt companies’ profitability, and government support has been shrinking during the same period. It is not easy to secure a new driving force as the management of public enterprises, which have played a leading role, has deteriorated.

Contrary to domestic circumstances, however, business activities continue to take place overseas despite falling oil prices. Some companies are already in decline, but others survive and expand their territory. Major companies, in particular, have grown so far and will remain unshakable in the future despite facing numerous crises during their long business activities. Therefore, looking into their competitiveness and strategies will help Korea’s companies overcome the crisis and continue to grow.

It is necessary to take a brief look at the oil industry’s characteristics before finding out how oil companies survive. First of all, the oil industry, especially the upstream sector (E&P industry), is a representative high-risk high- return business. Development is long-term, large-scale, and highly likely to fail. However, if successful, the company can reap enormous profits for a long time. This is why risk management is paramount in the oil industry.

Second, it is challenging to predict the price of oil. Oil is the most active raw material traded in the global commodity market, and the price is naturally set in the international market. Oil prices are heavily influenced by demand and supply, but also, they are affected by many factors, such as political issues and geopolitical issues. Oil prices have a full effect on the entire oil industry, despite the difficulty of forecasting. Even businesses that were commercial until yesterday could lose their business immediately if oil prices go down. It is crucial to create a business structure that can steadily reap profits regardless of the fluctuation of oil prices.

Third, shale gas E&P has brought about a significant change in the oil industry. The development of the gas has led the United States, the world’s largest oil importer, to become the world’s largest oil producer and export. In the past few decades, there has been an overall prospect among experts that oil will run out in 20-30 years. However, now oil is still abundant, and shale gas development has made the supply more plentiful. What’s seen here is that the era of high oil prices above $100 is difficult to come back, as in the past. Of course, oil prices may be affected by several other issues and become temporarily high oil prices, but overall, low oil prices will have no choice but to maintain their trend.

There are two ways for oil companies to survive at low oil prices. One is to secure oil fields that cost less to produce than competitors. The other is to make the process of producing oil as efficient as possible and diversify businesses. The former would be the right way for the national oil companies in the Middle East, and most of the oil companies would have to follow the latter. ExxonMobil is one of the world’s most experienced companies in the latter’s business style. This research will be an opportunity to look at ExxonMobil’s operation plans covering all areas of the oil industry to identify the factors necessary to achieve the world’s highest production and operation capabilities.

Company Profile and Strategy Alignment

While the unique characteristics of the oil industry have a common impact on all oil companies’ production operations, each company has its business strategy, which is deeply related to the company’s current competitiveness and position in the market. First of all, ExxonMobil is the world’s largest private oil company, with $280 billion sales and 71,000 employees, as of 2018 (GlobalData, 2019). Oil companies are classified mainly into three categories: integrated oil companies that cover all processes upstream and downstream, independent companies that only participate in the upstream, and service companies that provide services and equipment. Of these, ExxonMobil operates business vertically integrated upstream, downstream, and even petrochemical industries.

Thus, ExxonMobil’s basic strategy seeks to increase productivity and efficiency by forming a diverse portfolio in the upstream to create a foundation for sustainable growth and optionally developing resources in the business- friendly areas depending on the situation. Downstream sets the highest operating goals, provides differentiated products optimized to customers based on technical skills, and maintains competitive advantage through upstream and downstream integration.

The SWOT analysis shows the current status of ExxonMobil’s competitiveness (Table 1). First of all, ExxonMobil’s strengths include abundant reserves and an integrated operating system. ExxonMobil is expanding its reserves by continually exploring and developing new areas regardless of oil prices. As of 2018, the total reserves are 24,293 million barrels, 67.6% of which are completed for commercial production. The company’s reserves are located in Europe, Asia, Australia, Oceania, Africa, and the Americas. Such abundant reserves provide a foundation for the company’s continued growth.

Table 1.

SWOT analysis for ExxonMobil

Next, Exxon Mobil is an integrated oil company that operates in all parts of the oil and gas industries. The vertical integrated operating system has enabled the company to reduce its dependence on third parties and respond more effectively to changes in the business environment. ExxonMobil flexibly produces a variety of petroleum products, including gasoline, diesel, jet fuel, chemicals, and lubricants, and also has a logistics system to provide cost-effective transportation. The details will now be described in the value chain part.

ExxonMobil’s net working capital deficit and weak margins in the chemical sector are its main weaknesses. In 2018, ExxonMobil recorded net working capital deficit, with its current liabilities of $57,138 million, more than its existing assets of $47,973 million. Overall, this may not be a big problem when the industry is in good shape, but otherwise, it may cause financial instability and make it difficult for the company to repay its short-term debt. That increases the interest burden by borrowing another short- term financing.

Besides, the decline in profits in the chemical sector was notable. This will eventually affect the company’s overall bottom line. Earnings in the chemical sector fell 28.8 percent on-year to $3,351 million in 2018. The decline in profits is attributable to weak margins and rising overall costs, which necessitates urgent improvements

Opportunities include increased fuel consumption and growth initiatives. According to the U.S. Energy Information Administration (EIA) (Globaldata, 2019), liquid fuel consumption in the U.S. is expected to rise to 20.8 million miles per day in 2018. Increased liquid fuel consumption is directly linked to increased sales of ExxonMobil.

Also, ExxonMobil continues to make new investments. It plans to invest $30 billion in new drilling and refinery construction in 2018. Besides, it has invested more than $10 billion in the development of Texas Golden Pass LNG along with Qatar Oil. ExxonMobil plans to invest more than $50 billion over the next five years, including Golden Pass. The oil industry is a large-scale device industry, and aggressive equipment investment must precede it to lead the market.

Threats include development risks and fluctuating oil prices. As previously described, the success rate of exploration and development in the oil industry is shallow. ExxonMobil found six empty wells in the exploration drilling in 2018. In this case, the cost restoring the region to its original state and the cost of existing inputs are significant. In addition, environmental damage may result in unexpected forces or fires, resulting in loss of lives and property. Oil companies are always exposed to exploration risks like this. Another major threat is oil prices. Oil prices have an absolute impact on the company’s performance and financial position but will be determined by factors beyond the company’s control. As oil prices change, the company is forced to modify all strategies to run the business.

Meanwhile, the five forces (Buyer power, Supplier power, Degree of rivalry, New entrants, Substitutes) analysis of the oil industry also has many implications for oil companies in setting up their operational strategies. Oil companies are generally large-scale, both state-owned and private, and are a highly competitive market among existing operators. Today’s global private companies are all companies with a long history and have long been vertically integrated and diversified. So it is challenging for a new player to enter the market. The power of suppliers who are oil and gas equipment and services providers such as Schlumberger, GE, or Haliburton is generally weak. However, if the number of suppliers for specific goods or services is limited, the suppliers may have some market power. In particular, suppliers who enjoy exclusive status through mergers and acquisitions may exert a relatively strong influence (MarketLine, 2018).

In the case of buyers, they may be individuals or entities or institutions. Because petroleum products are essential in most industries, the buyer’s market power is rather weak because of the variety of buyers. There is a characteristic that the buyer’s loyalty to the brand is thin. The effect of the substitute is expected to grow stronger. In the past, falling oil prices, which began in late 2014, have reduced the value of the entire oil market. Also, the alternative energy market is proliferating as each government’s policies shift toward renewable energy rather than conventional fossil fuels (MarketLine, 2018).

Key Performance Indicators and Measures

All organizations have goals they want to achieve and regularly check the distance from their current state and make up for shortfalls. It is difficult to quantify and manage all of the organization’s activities, and it is inefficient. Not only is it necessary to achieve the goal, but it is also essential to identify and manage factors that may motivate the organization to work in the desired direction. These are performance indicators, which should be controllable and measurable in the organization. Organizations with well-managed performance indicators can make data- driven decisions and maximize organizational efficiency. ExxonMobil is a vertically integrated oil company whose business areas vary, allowing it to have performance indicators suitable for each area.

First of all, the proved reserves replacement ratio (RRR) and the return on average capital employed (ROACE) can be the leading performance indicators in the upstream sector that produces crude oil. The RRR is a production indicator used to identify the performance of the company’s production operations. The RRR compares additional proven reserves and production in a year, which naturally requires more proven reserves to sustain business in the long run. In the case of ExxonMobil, production decreased slightly year-on-year to 3,833 barrels, but the RRR stood at 318 percent, up sharply from 189 percent a year earlier. The ROACE is a financial indicator that is useful in analyzing the business of capital-intensive industries, such as the oil industry, as an indicator of profitability against the company’s investment costs. Sales and net income may also be important performance indicators. Still, they are more sensitive to oil prices or temporary changes and cannot determine the company’s business efficiency. The ROACE of ExxonMobil edged up on-year to 7.9 percent (ExxonMobil, 2019a).

Next, in the downstream sector of transporting and refining oil, refinery throughput, and ROACE can be the main performance indicators. As a measure of production, refinery throughput can measure the company’s ability to produce physically. Oil refining is typically an area where economies of scale operate, with larger plants more advantageous to competition, provided that other variables are the same. ExxonMobil recorded 4,272 thousands of barrels per day(b/d) in 2018, almost the same as the previous year. The ROACE, like upstream, is an essential financial indicator, with Exxon recording 23.3%, a slight on-year decline (ExxonMobil, 2019a).

In the chemical area, where refined oil is used to make several chemicals, ethylene production, and ROACE can be the main performance indicators. Ethylene is the essential substance produced in petrochemical plants, with ethylene production soon representing the company’s production capacity for chemical products. ExxonMobil recorded 9,040 thousands of tons in 2018. Also, the ROACE in the chemical sector was 11 percent, down from 16.4 percent a year earlier. As previously described, worsening returns in the chemical sector are serving as a weakness for ExxonMobil (ExxonMobil, 2019a).

Meanwhile, key performance indicators are commonly applied across the entire business area, such as sustainability. Sustainability is essential for a corporation seeking eternal business. Important factors in terms of sustainability as an oil company include safety, climate change response, environmental performance, and social responsibility.

There are many unforeseen accidents in oil-related facilities from upstream to the chemical. Once an accident occurs, it is easy to cause severe financial damage as well as human casualties. For oil companies to be sustainable, it is imperative to minimize the loss of workers’ lives. ExxonMobil considers safety first from the stage of facility design and construction and has a response system that can quickly respond to emergencies. ExxonMobil manages safety indicators such as the Lost-time Incident rate and fatalities. As of 2017, the Lost-time Incident rate stood at 0.029, less than half the average of 0.08 for the U.S. oil industry. Deaths stand at one digit each year, compared with two in 2017 (ExxonMobil, 2018a).

Next, ExxonMobil strives to reduce greenhouse gas emissions in response to climate change. Since the oil industry produces massive carbon dioxide and greenhouse gases, reducing greenhouse gas emissions is inevitable for all oil companies. ExxonMobil cut its greenhouse gas emissions by 168 million tons from 2008 to 2017. As of 2017, the company had reduced 23.4 million tons and released about 120 million tons (ExxonMobil, 2018a). In terms of social responsibilities, ExxonMobil is making some investments and strengthening cooperation for the development of the community in which its operations are located. In 2017, it invested $ 204 million in community development.

ExxonMobil also strives to minimize environmental damage by scientifically and in-depth analysis of the impact of business activities on the environment when developing and operating projects. It is an important part of sustainability, not only because it will not be granted business licenses in the first place, but also because it can suffer tangible and intangible losses from environmental damage. ExxonMobil is managing water consumption, an outflow of hydrocarbons from marine ships, and environmental penalties for environment-related indicators. In particular, ExxonMobil consumes a lot of water in the hydraulic crushing process for oil production. ExxonMobil tried to reduce water consumption by utilizing water conservation and wastewater recycling technologies and consumed 300 million cubic meters in 2017, down 20 percent from 2007 (ExxonMobil, 2018a).

Supply Chain and Value Chain

As previously described, the oil industry consists of upstream, downstream, transporting, refining, and chemical areas. All of these processes require primary oil reserves, capital and workforce, various information, and production/ transmission/revision facilities. Global major companies like ExxonMobil run the entire process, but that doesn’t mean they do all the work themselves. In areas where input costs and human resources are not profitable, or expertise is difficult to attain, various goods and services will be supplied through contracts with multiple suppliers.

It is possible to create value through operational integration in the oil industry. Integration has horizontal and vertical integration, both of which are necessary for the oil industry. Through horizontal integration, companies can achieve economies of scale. Even though small operations do not generate profits, large-scale operations can generate profits. Having a size above a certain level can lead the market and seize more opportunities. However, if various elements fail to converge from within, they can become inefficient organizations.

Vertical integration allows a single entity to operate all processes consistently with a clear view. Also, the risk of each process could be reduced. In particular, the oil industry is highly risky in the upstream sector. By operating upstream and downstream together, it will be able to cope with risks such as oil price fluctuations flexibly.

It is necessary to look at the process in which values are created at each stage of the value chain. Benefits are generally affected by three things. First, external circumstance has a significant influence on value creation. For example, at the upstream stage, the company’s discovery of a large amount of crude oil reserves creates tremendous value. Of course, it would not be easy to create value if the company had fewer reserves than expected earlier.

Next, an entity’s internal capabilities are a significant condition for value creation. A low-cost, high-efficiency process is a must-have capability for a company in the oil industry of numerous processes. Since the oil price will be cleared in the market and is volatile, it is important to lower the cost as much as possible to make it possible to produce in many oil fields, rather than adjusting the production cost to match the price of oil. The lower the cost, the more mining areas can be produced. Technology is also one of the core capabilities of companies. Companies with high-tech technologies can also be produced in oil fields. The development of sales gas, which has changed the paradigm of oil development over the past few years, is also possible because of the development of hydraulic fracturing and horizontal drilling methods.

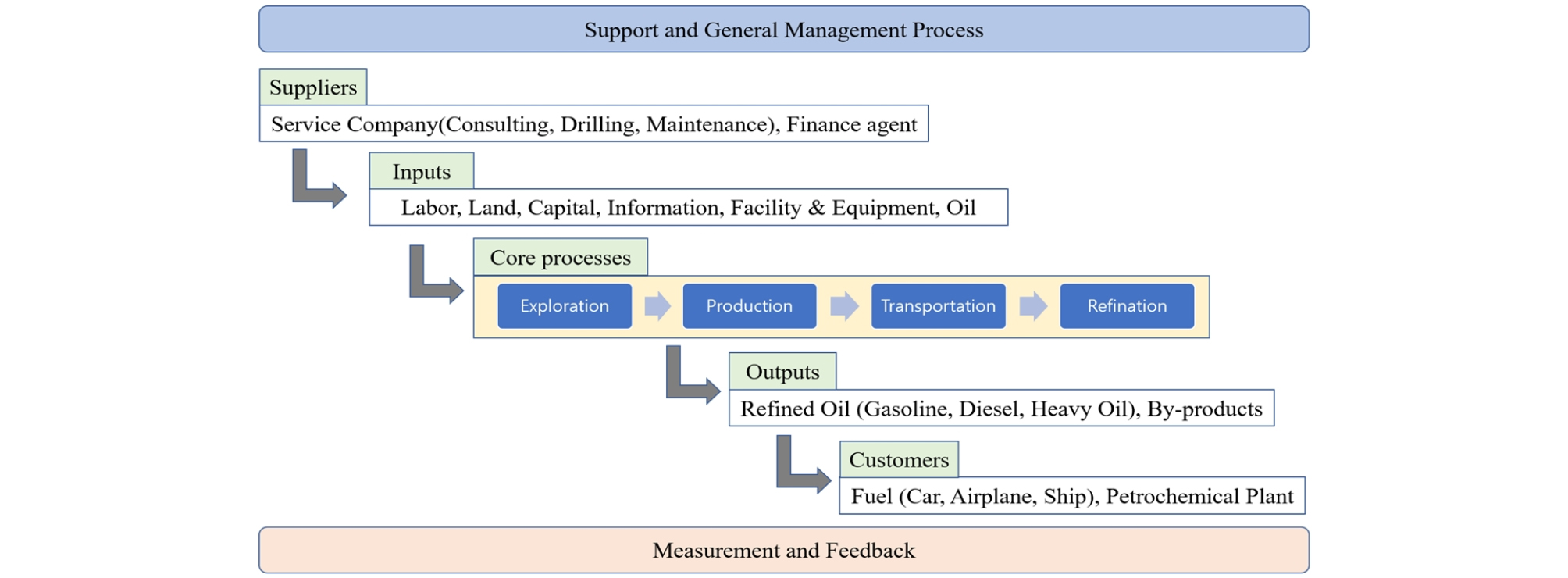

Third, the government’s policy could also affect the benefit of the oil development company. Under the policy of resource-rich countries, an extensive framework of projects would be set. Since most countries except the U.S. own land resources, resource-rich countries are involved in the formation of operators. The government also imposes various taxes on oil and oil-related products, which have a lot of impact on the business. Changes in the external circumstance, such as changes in oil prices and resource-rich countries’ political situation, make production plans revised. For example, if a resource-rich country’s financial situation has deteriorated, it may want to increase its daily output. Although the oil company hopes to comply with the existing production plan in consideration of its portfolio, it may change according to the resource-rich countries. To sum up, ExxonMobil’s Supply Chain and Value Chain can be expressed like Fig. 1.

Quality Control

Within the oil industry, the business characteristics of upstream, downstream, and chemical sectors are different, but they all have aspects of continuous processes. In other words, all the facilities continue to operate until oil is produced and delivered to the end-user. For example, drilling installations that have started production do not stop until production is finished. That is why quality control is more important than any other industry. If anyone quality defect occurs during various processes, the whole continuous process inevitably has to be stopped. It will cost more to restart the once-suspended facility.

ExxonMobil controls quality based on the Global Product Quality Management System (GPQMS). ExxonMobil secures ISO 9001 certification and maintains its quality control system at the highest level. From manufacturing products to distribution to customer feedback, everything related to quality is managed. Meanwhile, ExxonMobil is implementing a broader sense of quality management through its Operations Integrity Management System (OIMS). Back in 1989, Exxon caused the Valdez oil spill, which is considered the worst event in the history of the oil industry. The accident dealt a severe blow to ExxonMobil, but at the same time, it was a turning point. In the wake of this incident, ExxonMobil has made efforts to implement an operating decision system based on the system, and the OIMS was finally developed. The system addresses all aspects of the business that may affect safety, security, health and environment, and quality for personnel and processes (ExxonMobil, 2018b).

There are recommendations for the highest quality control. First of all, the independence of the quality department should be guaranteed. Most departments within the company focus on maximizing profits, but the quality department should assess whether the product’s quality is purely up to the standard. Therefore, the company independently, without compromise, and other organizations of the activities should be. Next, supplier management should be thorough. Global companies like ExxonMobil receive goods or services from numerous suppliers around the world. Failure to manage the suppliers will result in the poor quality of the entire process being supplied. Therefore, the supplier’s qualification requirements should be well assessed and managed. In addition, the organizational culture of quality improvement should be the foundation. To do this, quality must be placed in every employee’s consciousness, which is possible through education.

Future Strategy of ExxonMobil

The core of manufacturers’ competitiveness is technology. Even if an entity has all the other components, it cannot be competitive without technology. On the contrary, one of the essential reasons why ExxonMobil has become the world’s top oil company is its superior technology.

In the case of ExxonMobil, technology influence each process steps differently. First of all, technological prowess plays a role in making the impossible possible in the upstream. Without technology, one cannot find crude oil buried in the ground or the sea. Even in the production phase, it is challenging to produce oil economically without technical skills, and there are limitations to production. If the oil is buried below 5,000 feet of water, it is impossible to produce it without deep-sea drilling technology. Even if produced, it can provide as much as 50 percent of the oil buried without technology, and 80 percent if it is good at technology.

ExxonMobil, the company with the best E&P technology, discovered more than 5 billion barrels of resources in the deep waters of Guyana in 2018. ExxonMobil is also a digital technology leader, and can reliably collect real-time data from hundreds of miles of assets by leveraging an integrated cloud computing environment. Based on the data collected, optimized field operation is possible, and fast decision making is possible (ExxonMobil, 2019a).

Next, technological prowess in downstream and chemical makes high-quality products more affordable and mass- produced. Most of the products produced by global oil companies’ refineries and petrochemical plants are the same. For example, gasoline produced at ExxonMobil’s refinery and gasoline produced at Shell’s refinery are almost the same gasoline. However, even if the same product is produced, higher yields and greater margins can be obtained through streamlining the process. Therefore, the technical skills downstream can be seen as finding the optimal process system.

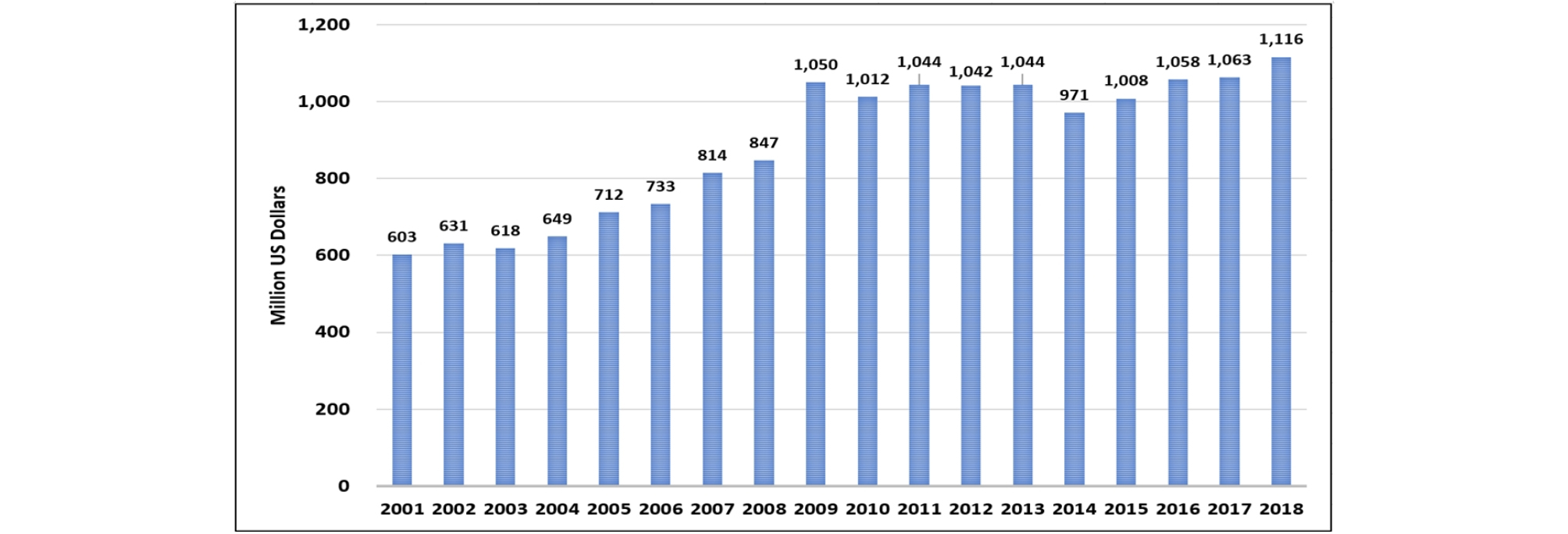

As of 2018, ExxonMobil invested $1,116 million in research & development (R&D). Its R&D expenditure has been increased continuously, but in 2014, when oil prices have plummeted, its R&D expenditure has dropped significantly to $971 million. However, it is steadily increasing its investment costs and making more investments than during high oil prices. In this way, generous investment in R&D is becoming a driving force for sustainable technology development (Fig. 2).

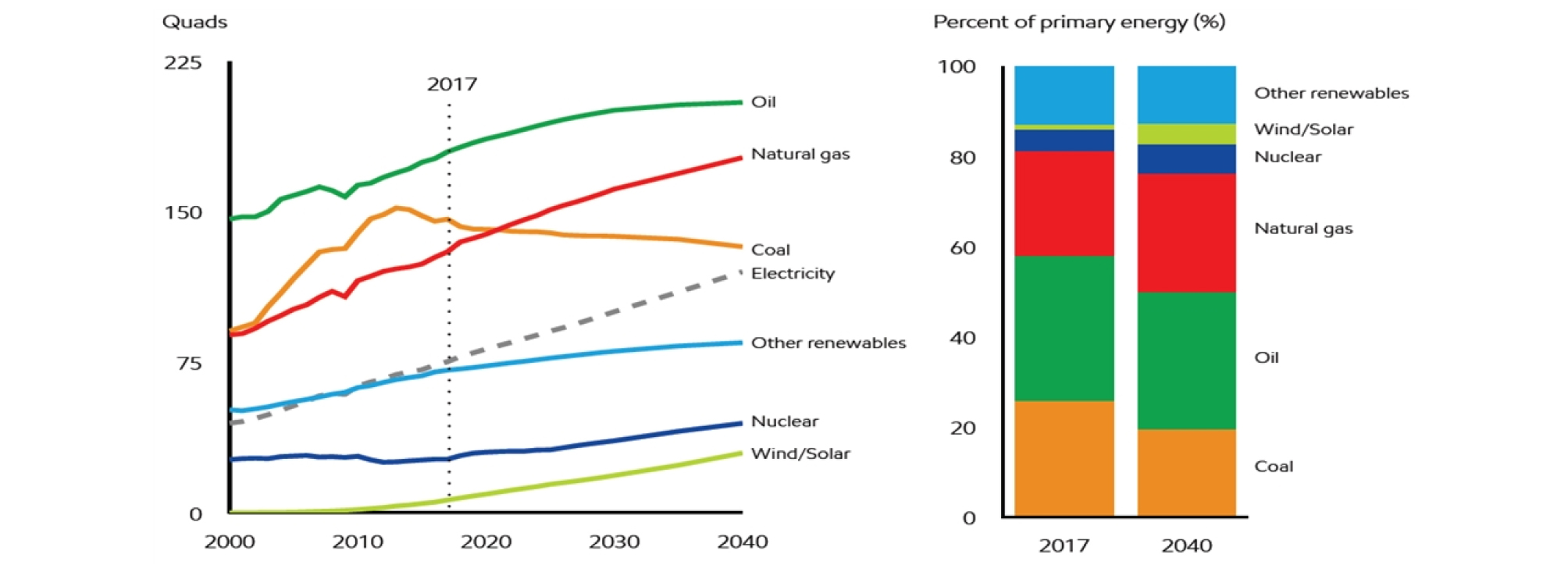

ExxonMobil has invested petrochemicals, carbon capture and storage (CCS), and biofuels in enhancing their core competence. Pickl (2019) stated that ExxonMobil had paid little attention to renewable electricity than other oil majors such as BP and Shell. Instead of solar PV and wind power, which are popular renewable sources, ExxonMobil has focused on fuel cells with CCS technology and non-food based biofuels. We think that ExxonMobil’s strategy is because of its somewhat optimistic outlook for the oil demand (Fig. 3).

ExxonMobil anticipated that the oil demand would steadily increase by 2040, whereas Equinor and McKinsey mentioned an oil demand peak around the 2030s. ExxonMobil’s strategy of investing conventional oil and gas assets, petrochemical facilities, and consistent R&D has resulted in a better performance than the others so far.

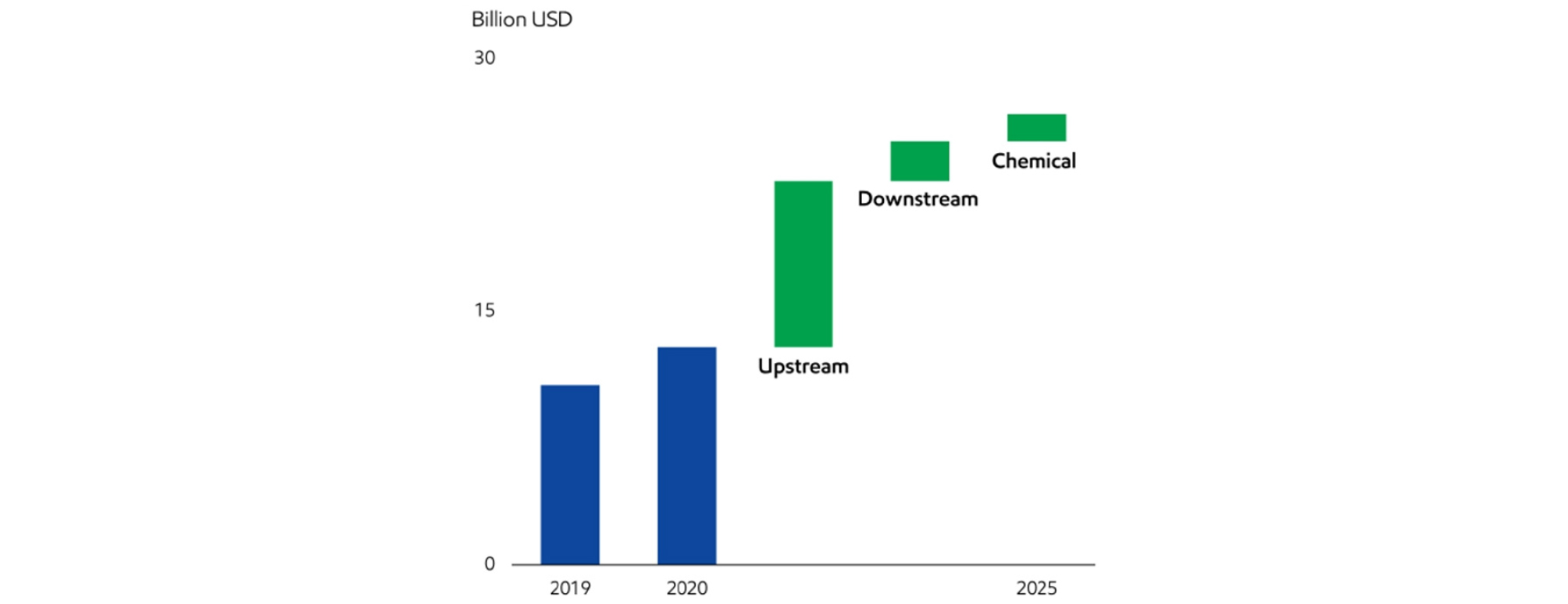

Because of the pandemic COVID-19, ExxonMobil recently announced a cost retrenchment by 30%. They cut their capital investments for 2020 into $23 billion, down from the previous estimate, $33 billion. ExxonMobil also tries to reduce their operating expenses by 15% from increased efficiencies and expected lower energy costs. But ExxonMobil also argues that the COVID-19 could eventually be surmounted, and they could maintain their outlook on the oil market. ExxonMobil’s diverse portfolio and technological competence can make their future sustainable. Note that they still expect that most of the revenues will be earned from the upstream sector (Fig. 4).

Conclusion

The oil industry is a capital-intensive, large-scale device industry, where an operation plan is more important than any other sector. In order to be competitive in the oil industry, it must first be scaled through vertical and horizontal integration. Next, an entity should diagnose its current capabilities to identify strengths and weaknesses and establish operational strategies accordingly. Proper performance indicators are needed to ensure that the strategy is being carried out properly and to motivate the members. Also, performance indicators should be able to reflect not only current but future goals, with ExxonMobil managing several indicators in production, yield, and sustainability.

There are many reasons why Exxon has been able to become the world’s largest oil company. Still, Exxon has already established an integrated system that should be built as an oil company and has tried to understand and maximize value at each stage of the value chain. It has maintained and developed a high level of quality control and technological power with preemptive investment. It is also doing its best to make investments for companies’ sustainable development and contribute to society.

Realistically, it is difficult for Korean companies to have a competitive edge at the level of ExxonMobil. Korea’s public enterprises only operate upstream businesses. In contrast, private companies both operate upstream and downstream, and there is a wide gap between them and major foreign companies in terms of size and technology. Therefore, there is a limit to dispersing risks independently of Korean companies. Nationwide, all available resources need to be utilized, and inter-company cooperation, especially public and private enterprises, need to be coordinated to disperse risks.

To this end, it is necessary to actively promote E&P through cooperation projects or joint ventures between public and private enterprises. If a public enterprise is in charge of high-risk exploration parts and finds an economically viable oil field, it would be desirable to cooperate with private companies to push for development. Besides, the public enterprise will be able to participate in the development of promising overseas oil fields that are difficult for private companies to secure by utilizing their credit and diplomatic cooperation among countries. Of course, if the government’s tax benefits are provided in the process, it will be able to secure more competitiveness.

Second, R&D should be pursued continuously. Securing technologies in core technology areas or niche areas means securing competitiveness. For example, in response to the digital transformation of the E&P industry, it will be possible to push for smart resource development that combines big data in the field with artificial intelligence technology that can analyze it. If Korea’s companies have a high level of technical skills in certain areas, they will also have opportunities to cooperate with advanced companies in the future.

Third, E&P in domestic oil fields should continue. ExxonMobil also has a strong base in the U.S., although it has operations in many foreign countries. Various experiences and know-how that cannot be given in overseas fields can be accumulated. It can also create a vibrant ecosystem of the E&P industry by building new supply chains and creating related service industries.